south dakota excise tax vs sales tax

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. South Dakota is a destination-based sales tax state.

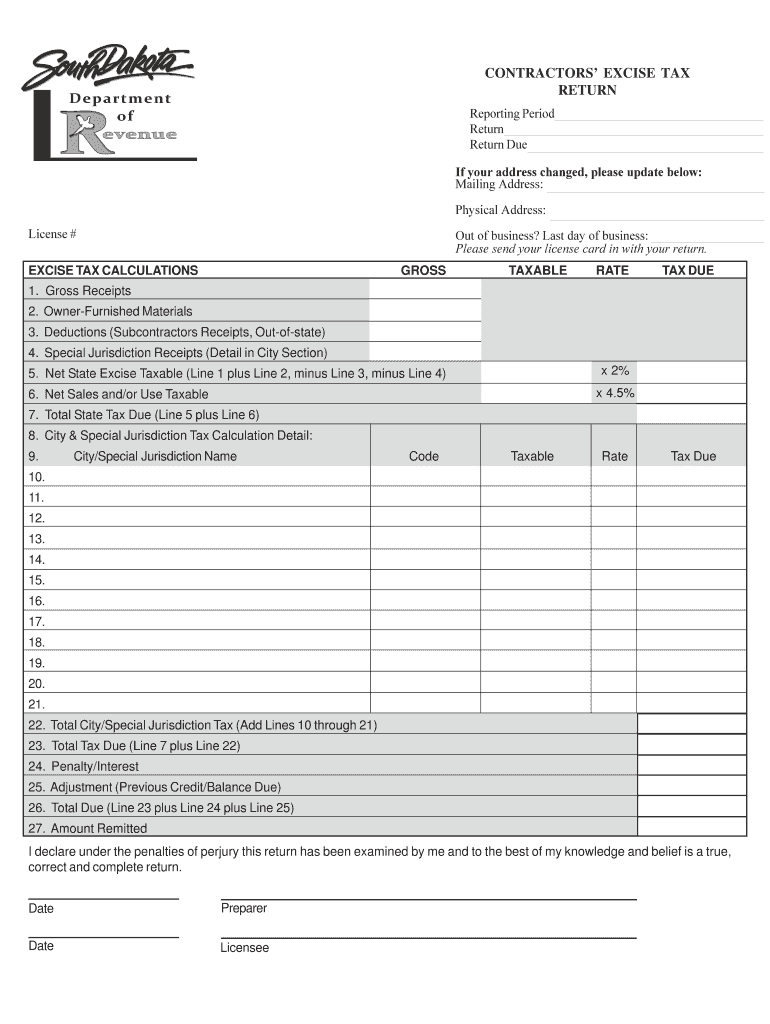

Contractor S Excise Tax South Dakota Department Of Revenue

Counties and cities can charge an additional local sales tax of up to 2 for a maximum.

. The South Dakota excise tax on liquor is 463 per gallon lower then 62 of the other 50 states. The state sales tax rate for South Dakota is 45. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

Pin En Born In Blood Mafia Chronicles Cora Reilly The state-wide. DAKOTA SOUTH DAKOTA WYOMING. The South Dakota Department of Revenue administers these taxes.

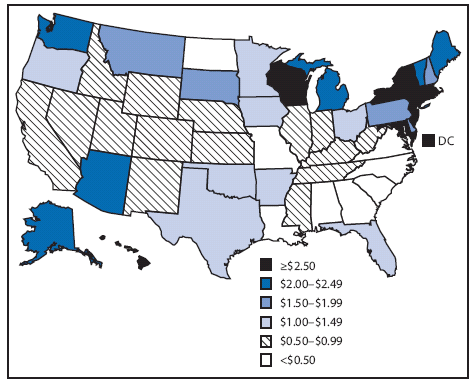

The end-users pay for the sales tax when they purchase a good or. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. The cigarette excise tax in South Dakota is 153 per pack of 20.

The state sales tax rate for South Dakota is 45. South Dakota Taxes and Rates State Sales Tax and Use. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

4500 The state has reduced rates for sales of certain types of. For more information on excise. South Dakota has a statewide sales tax rate of 45 which.

In order to recover. Owning a car can be rather expensive from the point of buying it. WHAT IS SALES TAX.

In addition contractors owe a 2 excise tax on the payments they receive for reality improvement projects. 2 July 2019 Contractors Excise Tax Guide South Dakota Department of Revenue TABLE OF CONTENTS Aberdeen Office 14 South Main Suite 1-C Aberdeen SD 57401 Mitchell Office. The work must be for the.

The South Dakota sales tax and use tax rates are 45. Sales tax is imposed at the final stage of the supply chain and collected by the retailer. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

South Dakotas excise tax on Spirits is ranked 31 out of the 50 states. Wayfair Sales Tax Contractors Excise. The South Dakota sales tax and use tax rates are 45.

South Dakota Taxes and Rates State Sales Tax and Use. Contractors excise tax license itself must be displayed but that the license number should be written on or near the building permit. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. Sales Excise Tax for Municipalities South Dakota Finance Officers School June 2019 Alison Jares Deputy Director of Business Tax South Dakota vs. South Dakota Vehicle Excise Tax Explained.

South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to. South Dakota Taxes and Rates State Sales Tax and Use. It also applies to the sale of services and.

But that is not all as there are other payments you have to make as well. Beer is 027 per gallon. Same general rates as sales tax 10-46-2.

Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that. Therefore the South Dakota sales tax is imposed on gross receipts of all retailers including the lease and sale of real or tangible personal property. The cigarette excise tax in South Dakota is 153 per pack of 20.

Same general rates as sales tax 10-46-2. Depending on local municipalities the total tax rate can be as high as 6.

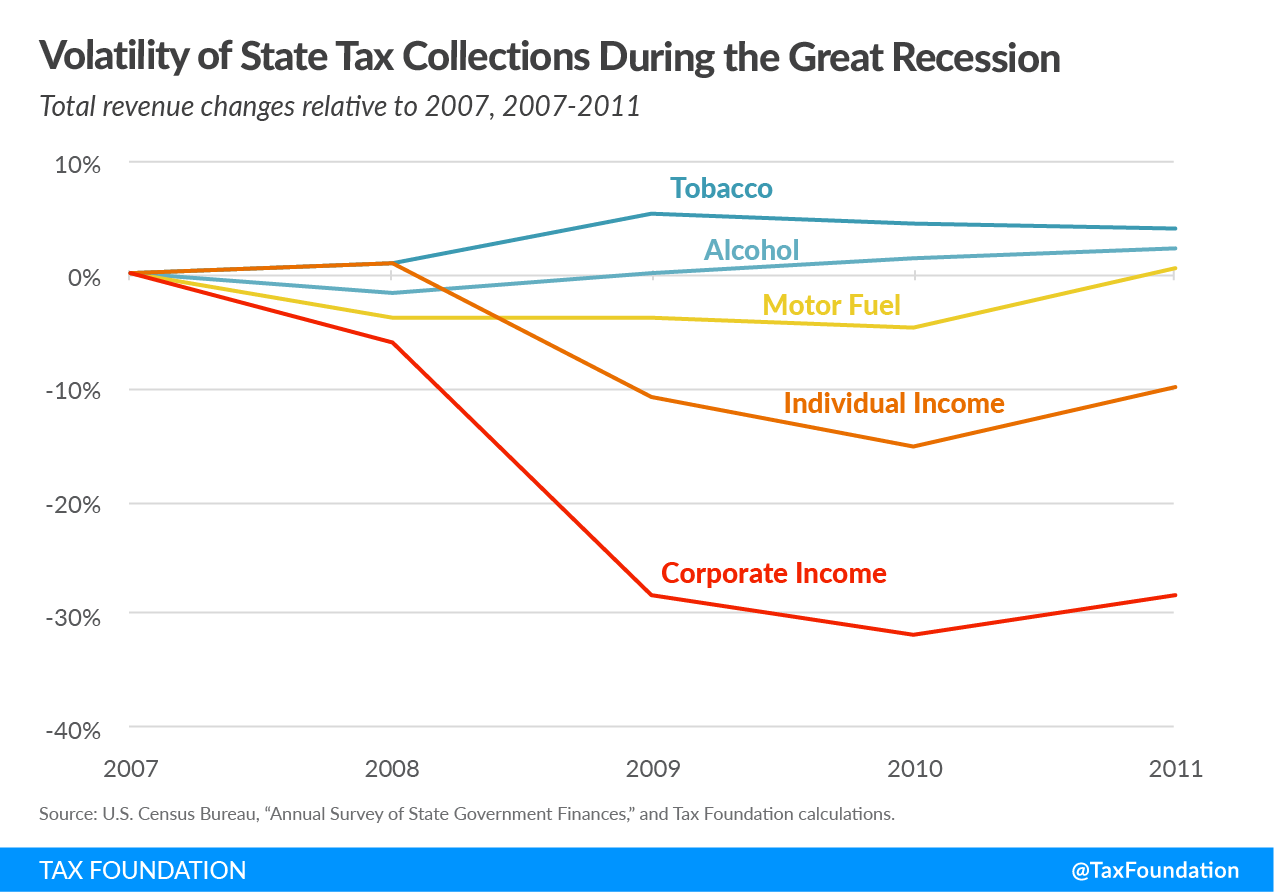

What Happens With State Excise Tax Revenues During A Pandemic

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Use Tax South Dakota Department Of Revenue

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Exhibit 1 10 A Sales Tax Versus An Excise Tax

Pro Growth Tax Reform Through Broadening Sales Tax Itr Foundation

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

How To Calculate Cannabis Taxes At Your Dispensary

Sales Use Tax South Dakota Department Of Revenue

Sales Taxes Vs Excise Taxes Case Study Taxedu

South Dakota Guidelines For Sales Tax In Indian Country Avalara

South Dakota Income Tax Calculator Smartasset

South Dakota Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

State Cigarette Excise Taxes United States 2009

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

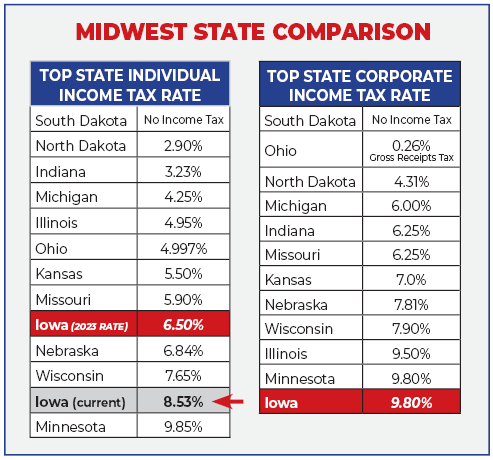

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

Sales Tax Definition How It Works How To Calculate It Bankrate