pinellas county sales tax rate 2019

Free Unlimited Searches Try Now. The Florida state sales tax rate is currently.

The Hidden Fun Facts Of Real Estate We Had No Clue Did You Realestate Realtor Justlisted Real Estate Fun Real Estate Fun Fact Friday

10 rows County.

. Board members voted unanimously for a 16 billion budget that locked in a tax rate of. Continues at 1 Rate The combined state and local sales and use tax rate for Pinellas County will continue to be 7. The new sales tax rate will be applicable to all payments of rent attributable to the period beginning on or after January 1 2020 even if such amounts are prepaid prior to that time.

Accordingly the sales tax rate for the Florida counties in which FIU has taxable activities is. All state sales and use tax and local surtax collected must be reported and remitted to the Florida Department of Revenue. NEW LAWS IN EFFECT JANUARY 1 2020.

The cities of Florida andor municipalities do not have a city sales tax. There is no applicable city tax or special tax. 55 PLUS THE LOCAL SURTAX.

The latest sales tax rate for Palm Harbor FL. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where the building is located. You can print a 7 sales tax table here.

What are millage rates. On January 1 2020 the Florida sales tax rate on. The 7 sales tax rate in Pinellas Park consists of 6 Florida state sales tax and 1 Pinellas County sales tax.

To review the rules in Florida visit our state. So for example the sales tax rate in Hillsborough County will be 80 55 plus 25 local surtax while the tax in Orange. THE 2022 FLORIDA SALES TAX RATE ON COMMERCIAL RENT IS STILL.

For tax rates in other cities see Florida sales taxes by city and county. The Pinellas County School Board meets on Sept. In addition Pinellas County residents will pay the 1 Pinellas County local option sales tax on the first 5000 of the taxable amount.

View past years millage rates below. Certificate holders use Lienhub to run estimates and make application for tax deed. So the current Florida sales tax rate on commercial rent as of January 1 2022 is 55 plus the local discretionary surtax rate.

Florida The Florida general state sales tax rate is 6. The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state reciprocal with Florida. The Penny for Pinellas became effective.

This rate includes any state county city and local sales taxes. June 4 2019 329 PM. 60 to County Sales Tax Pinellas County charges a 10 percent Local Discretionary Sales Surtax specifically the Local Government Infrastructure Sales Surtax more commonly referred to as the Penny for Pinellas This sales tax was first adopted in 1987 and will expire at the end of 2029.

Ad Get State Sales Tax Rates. The Pinellas County sales tax rate is. The tax collectors office does not set millage rates.

On January 1 2020 the state tax rate was reduced from 57 o 55. Miami-Dade County 70 due to the additional 10 surtax Broward County 70 due to the additional 10 surtax Pinellas County 70 due to the additional 10 surtax Real Property Rental Lease or License. 2020 rates included for use while preparing your income tax deduction.

The combined rate is composed of the 6 state sales tax plus the 1 local government infrastructure surtax. Pinellas county sales tax rate 2019 What is pinellas county sales tax. 10 rows 2019.

05 lower than the maximum sales tax in FL. Each 2021 combined rates above are the results of the Florida state rate 6 the county rate 0 to 2. Millage rates are set by the Board of County Commissioners School Board cities in Pinellas County and other taxing authorities.

The latest estimates put the rate reduction to take place sometime during 2024. The combined sales tax and discretionary sales surtax rate for certain Florida counties for 2019 and 2020 are listed below. How much is sales tax in pinellas county.

The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements. The amount per 1000 used to calculate property taxes.

05 January 1 2019 December 31 2030 5 July 1 2005 100 Living and Sleeping Accommodations 70 All Other Taxable Transactions 05 January 1 2017 - December 31 2026. Download tax rate tables by state or find rates for individual addresses. 10 2019 to approve its budget for the 2019-20 fiscal year.

This is the total of state and county sales tax rates.

St Pete Eyes 10 Million Revenue Shortfall St Pete Catalyst

10 Useful Online Tools In 2021 Personal Development Tools Online Tools Learning Quotes

U S States With Highest Gas Tax 2021 Statista

Real Estate Blog Being A Landlord Rent Rent Vs Buy

2015 Florida Hotel Tax Rates By County

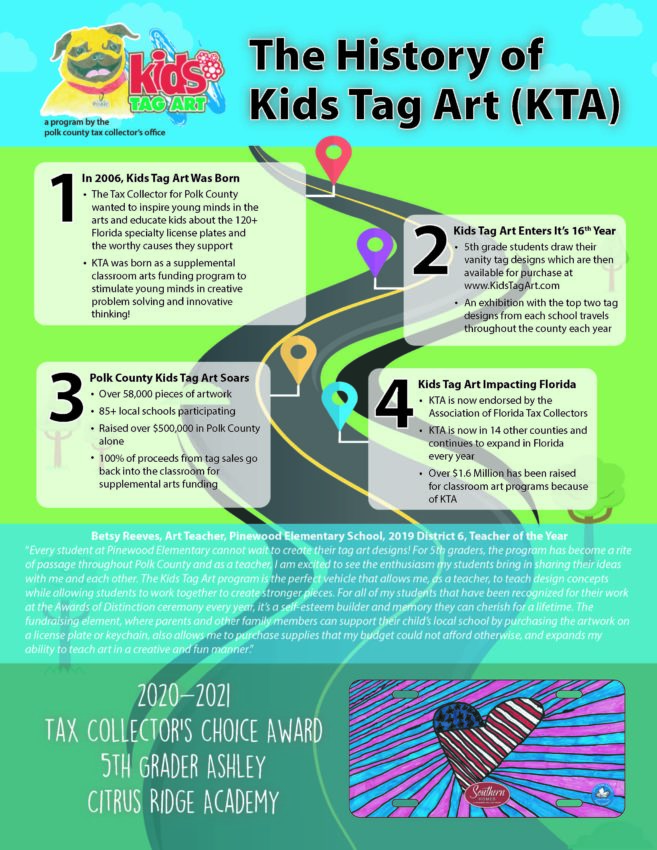

Kids Tag Art Story Polk County Tax Collector

2015 Florida Hotel Tax Rates By County

2015 Florida Hotel Tax Rates By County

Javma News In Journal Of The American Veterinary Medical Association Volume 259 Issue 6 2021 Missing Key App Site Title Suffix

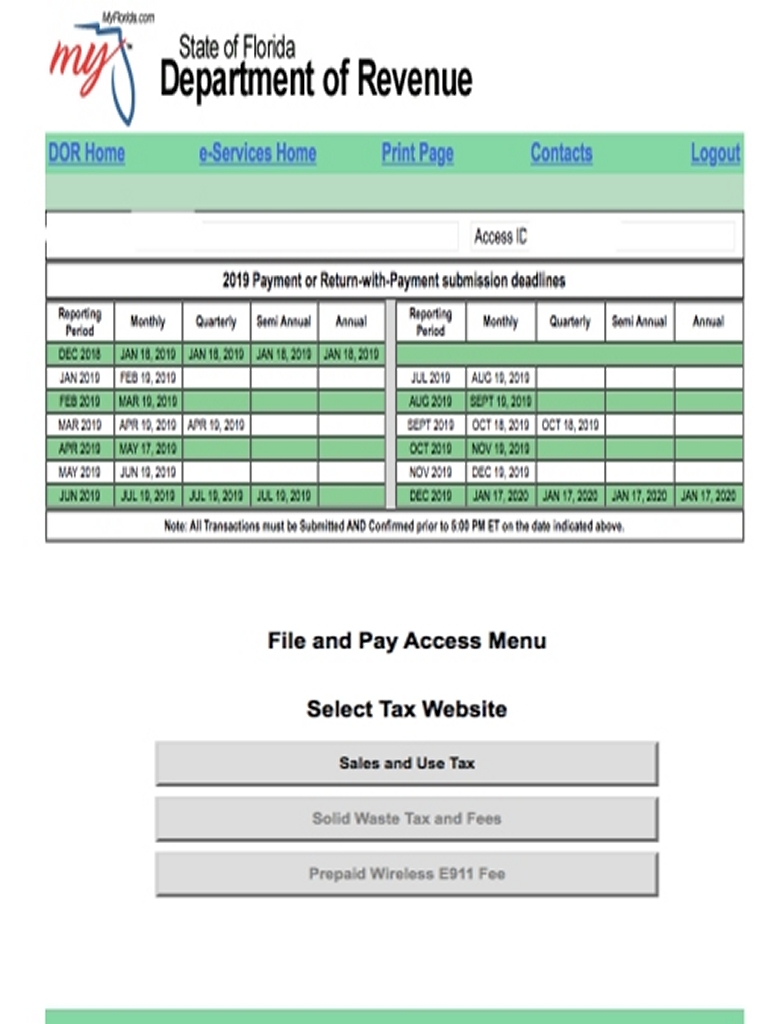

Florida Sales Tax Returns Filings Our Florida Accounting Tax Advisers Team Can Help You Stay Current With All Your Florida Sales Tax Returns Filings