are funeral expenses tax deductible in ireland

Ireland on May 23 1945 Paul was the oldest son of John and Sheila Burgess. If you are eligible to deduct funeral expenses on your estates tax returns be aware that not all funeral expenses are tax-deductible.

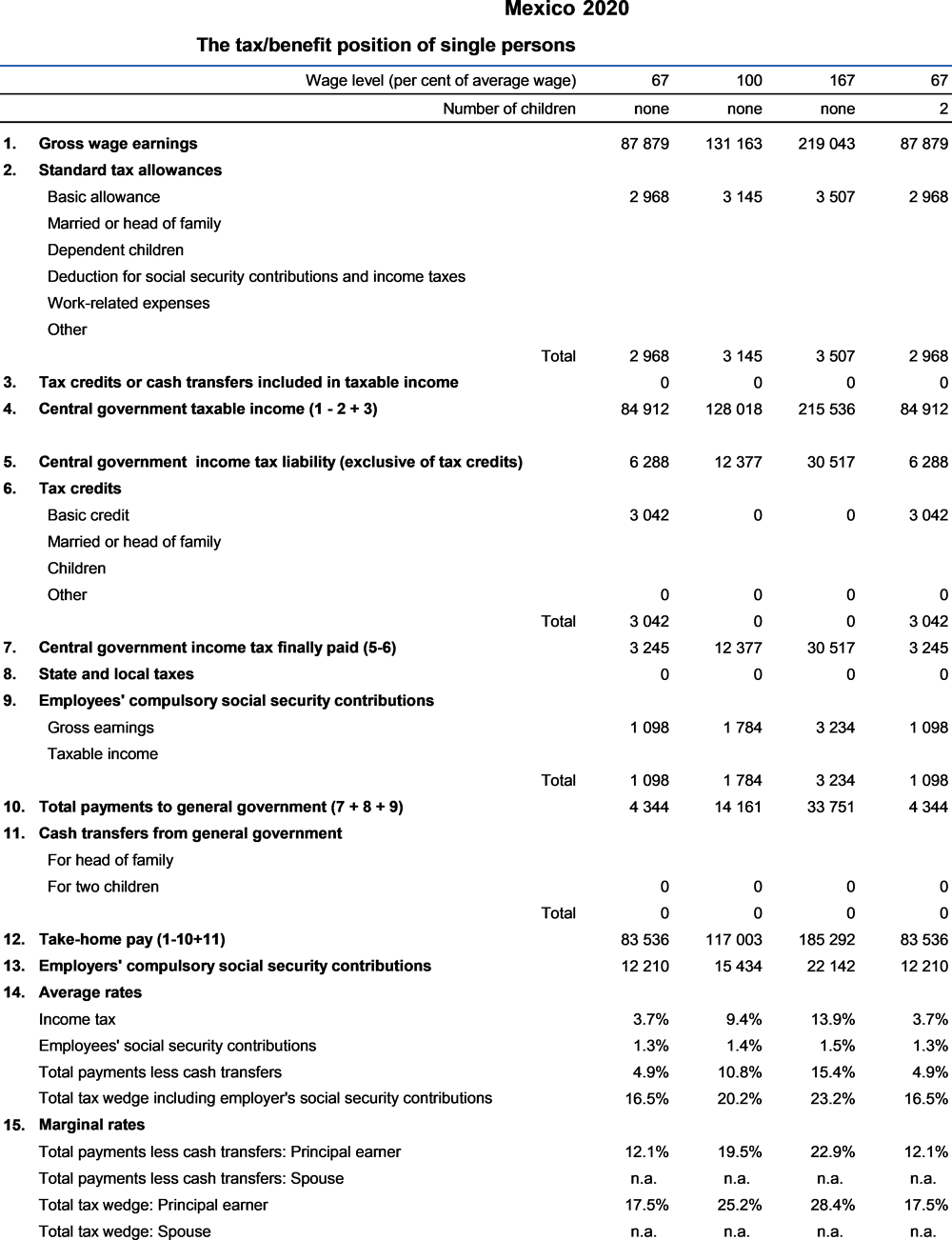

Mexico Taxing Wages 2021 Oecd Ilibrary

A Widowed Person or Surviving Civil.

. In arriving at the taxable value of the estate the following deductions from the gross estate are allowable. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. IRS rules dictate that all estates worth.

Feb 21 2019. Unfortunately funeral expenses are not tax-deductible for individual taxpayersThis means that you cannot deduct the cost of a funeral from your. Can you write off a funeral expense on your taxes.

In order for funeral expenses to be deductible you would need to have paid. Tax-deductible funeral expenses. Probate Tax - Testamentary Expenses.

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a. Individual taxpayers cannot deduct funeral expenses on their tax return.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Many estates do not actually use. Knowing if your funeral expenses count as a medical expense is essential.

In other words if you die and your heirs pay for the funeral. If you spend money on something that is for both business and private use you can claim a deduction for part of the. The Internal Revenue Service IRS requires individuals with a gross value of at least.

Where can a decedents funeral expenses be deducted. Funeral Cover Credit Life Cover. What funeral expenses are deductible.

While the IRS allows deductions for medical. You will get the Married Person or Civil Partners Tax Credit in the year of death. Not all estates pay federal taxes so many cannot get tax deductions on funeral expenses.

While the IRS allows deductions for medical expenses funeral costs are not included. Expenses that are for both business and private use. In the years following the year of death you will get.

Stamp duty legal costs. Medical expenses are any. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

The Taxation Committee has received the following letter from the Revenue Commissioners. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these. Are Funeral Expenses Tax.

Individual taxpayers cannot deduct funeral expenses on their tax return. However only estates worth over 1206 million are eligible for these tax. This could affect whether or not youre able to deduct the cost from your taxes.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Funeral costs can vary widely depending on what you choose and depending on whether it is a city or country funeral rural funeral costs are generally less. Debts of the deceased due at the date of death and funeral.

This is 3400 in 2022.

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Are Funeral Expenses Tax Deductible Youtube

Funeral Expenses Tax Deductible Irs Best Reviews

Simple Paye Taxes Guide Tax Refund Ireland

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Tax And Legal News April 2022 Ey Czech Republic

Pittsburgh Irish Happenings Irish Heritage Month Events Return News And Events Iirish

Ecommerce Business Insurance Options For Retailers 2022 Shopify Ireland

Italy Taxation Of International Executives Kpmg Global

Advising Nonresidents And Recent U S Residents On Estate Tax Issues

What Is Commercial General Liability Insurance How To Protect Your Business From Financial Loss

The Odessa File People Of Schuyler County

Federal Program Offers Up To 9 000 Cash To Reimburse Covid 19 Funeral Costs

5 Tax Deductible Expenses For Executors Fifth Third Bank

Can You Claim A Funeral Or Burial As A Tax Deduction Cake Blog

Do You Have To Report 401k On Tax Return It Depends

Proposed Regulations Estate Tax Regulations Kpmg United States